Giving at Faith is becoming easier than ever before! As we focus our giving to two categories, “Tithe or Offering” and “Kingdom Builders,” we’re also transitioning to a new online giving experience. Our goal is to simplify your experience by combining your giving profile with all your other activities at Faith, and to continue to be good stewards of the resources that come in.

Give.

Giving made easy.

At Faith, giving isn’t about pressure — it’s about joyful obedience and generous partnership with what God is doing in the world. We believe in giving freely, willingly, and from the heart.

There are two primary ways we give: Tithe, which is the first 10% returned to God as an act of worship and obedience. And Kingdom Builders, an opportunity to go above and beyond — investing in missions, outreach, and raising up future leaders.

Giving is part of how we honor God, serve others, and build His Kingdom — together.

The Bible teaches that the first step of giving is the Tithe. Tithe refers to the first 10% of our income that ultimately belongs to the Lord. We tithe not only to honor and obey God but also to move the local church’s ministry forward.

Kingdom Builders is our second step of generosity that brings the Good News to all nations by investing in missionaries, ministries, and organizations doing strategic work to reach the lost and change the world so all may hear!

There are many ways to give.

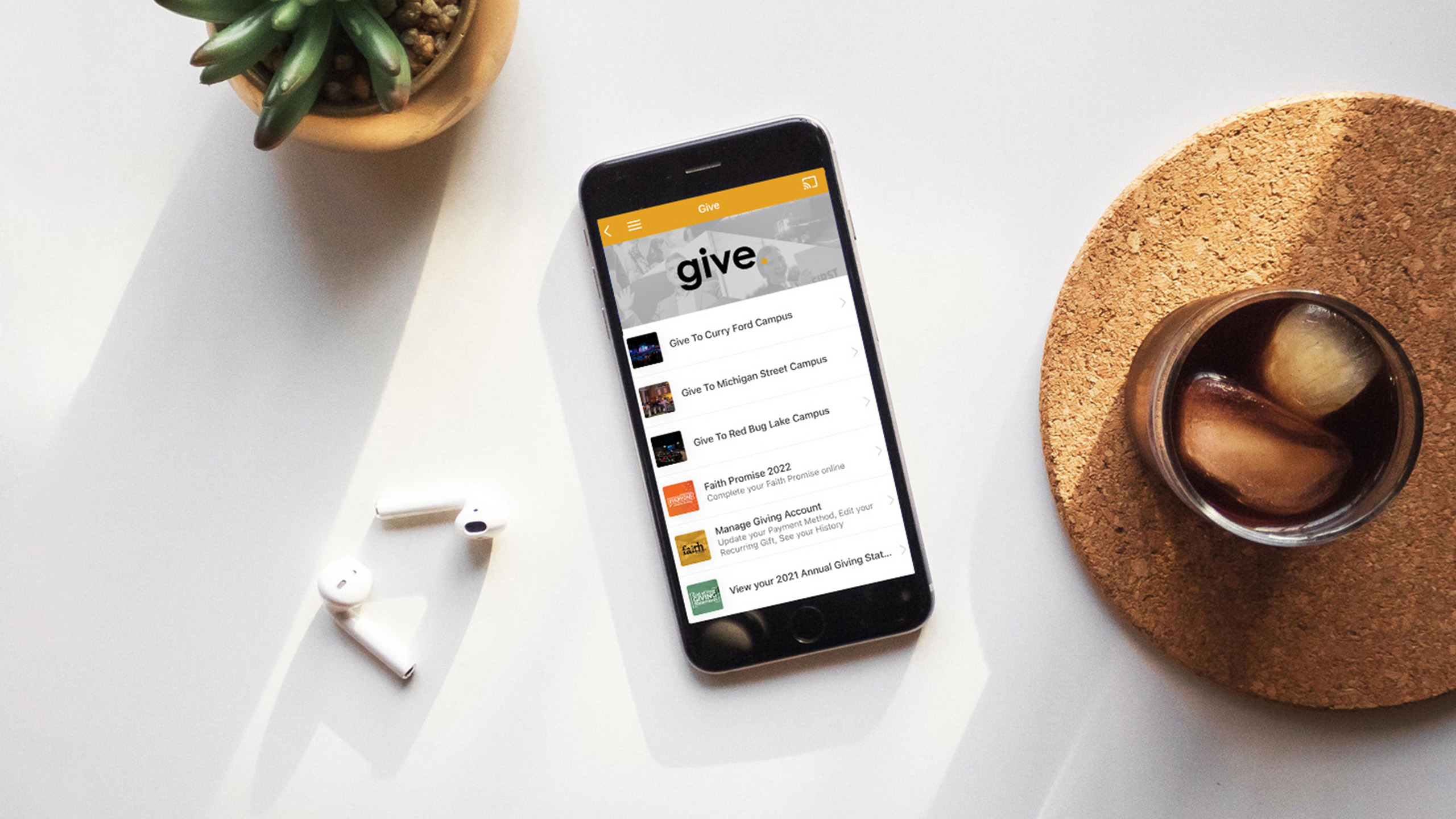

We understand that everyone manages their finances differently. That’s why we’ve made it simple for you to stay in control of your giving. Whether you prefer to give through the Faith App, text message, or in-person, we have the method that works best for you.

Text giving.

- To get started, text the amount & keyword to 84321. A link will be sent back to walk you through setting up Text2Give.

- To give subsequent gifts, text the amount & keyword to 84321.

e.g. “$250 to CFC” or “$200 to MSC-KB”

Give in person.

You can also give by cash or check using a Giving Envelope during any of our services.

Kingdom Builders — A Movement of Eternal Impact

At Faith, we’re entering a new season of giving — one focused, intentional, and driven by eternal purpose. Kingdom Builders is one of two key giving steps, designed for those who go above and beyond the Tithe to fuel global missions, local outreach, and the next generation.

When you give to Kingdom Builders, you’re helping plant churches in unreached areas, support life-saving compassion efforts, and empower future leaders — all so that every person has the chance to hear the name of Jesus.

Fewer offerings. Greater Kingdom impact. Let’s dream big, give boldly, and build the Kingdom — together.

FAQs.

If you need to edit your giving, you can log into our online giving platform by clicking HERE.

To access your giving statement online, log into your account HERE. If you need assistance in logging into your account, please contact the Finance Department at [email protected].

Yes, we provide access to an updated giving statement quarterly. To access your giving statement online, log into your account HERE and ensure your contact information is up-to-date.

If you’re new to tithing and wondering how to Tithe or how to calculate your tithing donation – we recommend starting with the biblical principle of giving 10% of your income (Malachi 3:10).

The Tithe represents our first fruits—the first 10% of our income that we return to God in faith, trusting that He can accomplish more with 90% than we ever could with 100%. By being faithful to the Tithe, you fuel the direct ministry of our local church, enabling it to thrive and grow.

Kingdom Builders isn’t an external organization; it’s a community of generous individuals within our church who choose to go above and beyond the Tithe. They step into a realm of generosity to fund global mission projects and help fulfill the Great Commission.

Kingdom Builders is activated after the Tithe (10%) and is the one “bucket” you can give towards to support various ministry outlets, both locally and globally.

As we faithfully bring the Tithe and give generously through Kingdom Builders, we trust that God will move powerfully in our lives. As a church, we don’t give to get—that’s not our motivation. Instead, we give with confidence, knowing that God is our provider.

In 2 Corinthians 9:11, Paul reminds us: “You will be enriched in every way so that you can be generous on every occasion…” As followers of Christ, we are blessed to be a blessing. Our generosity not only meets needs but also brings glory to God, resulting in thanksgiving to Him.

The greatest part about this lane of giving is that anyone can be a Kingdom Builder! By giving one penny above the Tithe, you start becoming a Kingdom Builder and join together with our church to partner with other churches and organizations around the world in what God is doing.

Through Kingdom Builders, we invest in local and global ministries dedicated to reach the lost, serving the poor, and transforming lives while advancing God’s kingdom. We proudly partner with reputable organizations like Builders International, Convoy of Hope, Live Dead, Teen Challenge, and many other initiatives committed to spreading the gospel to all nations.

As ministries of Faith, regular kids and youth programming are part of the storehouse, meaning they’re funded through the Tithe. Our Kids & Youth Ministries actively teach on the principle of giving and generosity, which means they will take on their own external projects throughout the year, just like we do in the adult services. As our Kids and Youth ministries focus on different giving projects throughout the year, students will give to the “Kingdom Builders” Kids and Youth funds.

As church-wide giving projects arise, we will update the congregation on what Kingdom Builders is presently supporting.

Our decisions are guided by several key commitments. As a Pentecostal organization, we prioritize supporting Assemblies of God initiatives in our missionary efforts. Recognizing that only 1.7% of global missions funding currently reaches the unreached, and with 42% of the world still without access to the Gospel, a significant portion of our missions fund is dedicated to frontline workers in the most challenging areas. We also support local projects that stem from established ministry partners we trust, which have proven to yield great fruit. Additionally, missionaries can apply for funding, allowing specific projects and emerging needs to be considered for support.

Planning Center Giving is our giving platform that allows you to choose your campus and give a single gift, or schedule recurring giving using your checking account, debit, or credit card.